Stop Guessing,

Start Trading With Logic.

How i Increased my win-rate DRASTICALLY, Using Orderflow in my Strategy!

Tired of not understanding why some trades work and others not?

I know I was.

And I completely understand how frustrating it is…

Some points of interest work out perfectly, and others not so well...

I spent years and years trying to understand and figure out how to differentiate between high and low probability trades.

And every time I thought I had it all figured out,

The market humbled me very quick and I was back to back-testing.

Even after trading price action for years, and after building

A decent, profitable system, I always believed there was a clearer and logical

Approach to trading than just looking at candles and random supply and demand zones to predict future moves.

A way where I could judge if the market was ready to move in my direction or not.

Such market analysis prowess would definitely change my game.

And it wasn’t until 2 years Later I accidentally stumbled upon the solution.

"My Art Gallery"

This is what orderflow allowed me to do... find strong volatile moves,

moves that will make me pips...

WHAT OTHERS ARE SAYING

"Incredible content and by far my favorite online mentors.

Very easy to digest in each sitting - They do an amazing job at teaching advanced principles in a simple way for anyone to understand and apply right away.

FU ACADEMY definitely OVER-DELIVERS

{FU Academy} Founder

After years of unprofitable and inconsistent trading, I decided to quit all of my jobs and studies to pursue trading full-time.

It was all or nothing. In just one year after that, I was able to start making more in a day than I used to in a month; once you taste this, you won't be able to go back.

Although the money is great, trading is such a lonely game that I decided to build an avid community of traders to help them follow the same steps I did but in a shorter time. it also meant I could have a great group of traders around me, win-win! I've assisted hundreds of people in becoming 5-6 figure traders.

My philosophy is straightforward. Do the opposite of what most people do. As a result, we look at the chart very differently than everyone else.

Get Access NowWhat can you see using Orderflow?

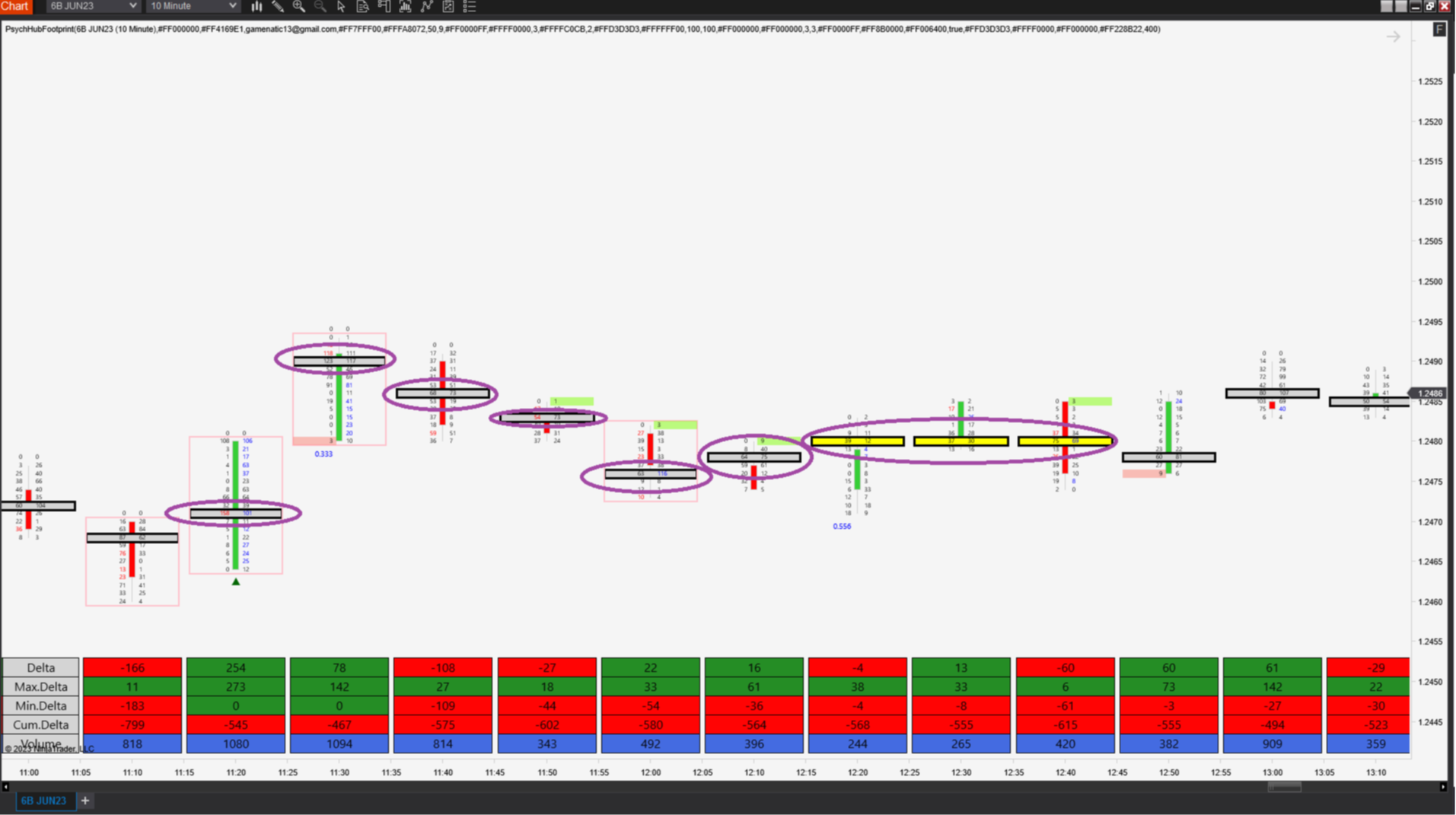

Statistical Panel

The Order Flow Footprint Statistical Panel provides a graphical representation of the order flow activity in a market. It provides valuable insights into the market participants' behavior and their trading activities.

The panel displays a set of statistical metrics, such as volume, delta, bid/ask volume, and cumulative delta. Delta is the difference between the buy and sell orders, and it indicates the market sentiment. A positive delta indicates a bullish sentiment, while a negative delta suggests a bearish sentiment.

Volume, on the other hand, shows the total number of contracts traded at a specific price level. By analyzing the delta and volume, traders can identify market trends, confirm price movements, and detect potential support and resistance levels.

Point of Control (POC)

POC stands for Point of Control, and it is a metric used in order flow analysis to identify the price level at which the maximum volume has been traded.

POC is a valuable tool because it provides traders with insights into the market's behavior at a particular price level. Traders use POC to identify price levels where the market has spent the most time and where liquidity is concentrated.

By focusing on these levels, traders can identify potential areas of support and resistance, which can help them make informed trading decisions.

Furthermore, POC can help traders determine whether the market is trending or trading in a range.

Exhaustions

Exhaustion prints in order flow analysis refer to price levels where there is a sudden surge in volume, followed by a reversal in the market trend.

These prints are indicative of market exhaustion and can signal a potential reversal in price direction. Traders use exhaustion prints to identify areas where traders who entered into the market at the previous trend's extreme may be looking to exit their positions.

By recognizing these levels, traders can anticipate potential price reversals, which can guide their trading decisions.

Imbalances

Imbalances in order flow occur when there is a significant difference between the buy and sell orders at a particular price level. These imbalances can indicate potential areas of support or resistance, and they can be useful for traders to identify short-term price movements.

Traders can also use imbalances to determine whether a market trend is likely to continue or reverse.

Additionally, imbalances can provide insight into the market's liquidity, helping traders identify areas where there may be a lack of buyers or sellers.

Multiple Imbalances

Multiple imbalances in order flow analysis occur when there are several price levels with significant differences between the buy and sell orders. These imbalances can provide traders with a comprehensive view of the market sentiment and potential areas of support and resistance.

By identifying multiple imbalances, traders can determine the strength of the market trend and the potential for a reversal. They can also identify areas where the market may consolidate, providing opportunities for range-bound trading strategies.

Candles with many imbalances tend to be high conviction and are marked out with a red box around the candle in the software.

CURRICULUM INCLUDES

Full Training Program

Carefully crafted lessons yet short to simplify the concept to you as much as possible.

I'm a huge believer in getting straight to the point and that's why I crafted my program in that way.

All value, 0 fluff.

Live Trading Sessions

2. What Camera Should You Invest In?

3. What Lens Should You Invest In?

4. Which Stabilizer Is Best For You?

5. Which Lights Should You Use?

6. Best Audio Gear To Have In Your Bag?

7. Which Drone Should You Consider?

8. Best Backpacks/Cases For Your Equipment?

Engaging Community

Look you know it, behind every successful person is a supportive team,

join one of the most engaging and supportive communities in the industry, packed with professionals and beginners alike

no matter what like you are at, no doubt you'll feel extremely welcomed and will be astounded at the value you'll gain

from being around such individuals. The saying is right "your circle is your future"

Invest in yourself today..

Learn to understand the markets from a logical perspective, enrol into a full training program teaching you all you'll ever need to trade like a true professional.

FREQUENTLY ASKED QUESTIONS

What kind of support or training is available with the Orderflow Footprint software?

Do I need to have any prior knowledge or experience in trading to use Orderflow Footprint software?

What Support and by whom will it be provided to me throughout the Program?

Can I use the Orderflow Footprint software with my existing trading strategy?

Do you Offer a Payment Plan?

Is there any hidden costs?

14-DAY REFUND POLICY

If for any reason you find that this program isn't for you, I will refund all your money no questions asked! I obviously don’t think it’ll come to that, but if you’re even the least bit worried if this will work for you, then put your mind at ease.

You either get the results you want or you get your money back. It’s that simple!